Agilent Technologies A Stock- A Closer Look

Thinking about where to put your money, you know, maybe a stock like Agilent Technologies, Inc. comes to mind. It's a common thought, too it's almost, looking at companies that do interesting things and wondering if they might be a good place for your cash. People often hear about different businesses, and some of them, like this one with its shares trading as "A," get talked about quite a bit in circles where money is discussed. It's a starting point for many who are curious about the markets, and honestly, it makes a lot of sense to begin by looking at a specific company.

When you start looking into a company's shares, you'll find there's quite a bit to see, actually. There are numbers that show what the shares are currently worth, stories about what the company has been up to, and a record of how its value has changed over time. All these pieces of information, so to speak, help paint a picture for anyone curious about making a financial move, giving them a sense of what has been happening and what the current situation is for a stock like this one.

Figuring out if you should get involved with a company's shares, or perhaps let go of some you already have, often comes down to gathering these bits of data. It's about getting a general sense of things, you see, before you make a choice about your money. This kind of research, basically, helps people feel more sure about their choices when it comes to something like the "A" stock, or any other company's shares, for that matter.

Table of Contents

- What is "a stock" like Agilent Technologies, anyway?

- Looking at "a stock" price and its story

- What news matters for "a stock"?

- How do people look at "a stock" to make choices?

- Getting a feel for "a stock" through its money picture

- Is "a stock" worth its current value?

- Where can you find information on "a stock"?

- What about short interest for "a stock"?

What is "a stock" like Agilent Technologies, anyway?

When we talk about "a stock," like the one for Agilent Technologies, Inc., what we're really talking about is a small piece of ownership in that company. Imagine a big pie; each share is just a tiny slice of that pie. So, if you own a share of Agilent, you essentially own a very, very small part of the whole business. This gives people a way to participate in the company's successes, or, you know, its struggles too, if things don't go as planned. It's a common way for companies to raise money and for individuals to try and grow their own wealth, basically.

Agilent Technologies, Inc. is a company that has its shares listed on a big exchange, and they go by the symbol "A." This symbol is like a shorthand name, making it easy to find their shares among all the others that are traded every day. So, when you see "A stock" mentioned, it's pretty much always referring to the shares of Agilent Technologies, Inc. This simple letter helps people keep track of what they are looking at, which is quite helpful when you're dealing with lots of different companies and their share prices, you know.

The company itself, Agilent Technologies, Inc., operates in areas that involve things like life sciences, diagnostics, and applied chemical markets. They make tools and services that help scientists and researchers do their work. So, when you're looking at their "A stock," you're really looking at a company that has a hand in some pretty significant scientific and health-related fields. It's a business that has a particular purpose, and that purpose is something that people often consider when they think about putting their money into a company's shares, in a way.

Understanding what the company does is, in some respects, a first step before you even look at the numbers. It gives you a general idea of the kind of business you might be supporting with your money. So, when you consider "a stock" like Agilent's, you're not just looking at a symbol; you're looking at a company with real operations and a place in the world, which is a pretty important thing to think about, actually, before you get involved.

Looking at "a stock" price and its story

One of the first things people usually check when they're interested in "a stock" is its current quote. This quote is just the price at which the shares are trading right now. It's like looking at the price tag on something you want to buy, but this price can change, you know, from one moment to the next during the trading day. Getting the latest quote for "A stock" gives you an immediate snapshot of what it's worth at that very second, which is pretty useful for anyone keeping an eye on things.

Beyond the current price, people often look at the history of "a stock." This means checking out how its price has moved over days, weeks, months, or even years. Seeing this past movement can give you a general idea of how stable or how much it changes over time. It's like looking at a story of the share's past life, which can, in some respects, offer clues about its tendencies. This historical data for "A stock" helps people spot patterns or see how it reacted to different events in the past, giving them a bit more to go on.

Charts are another way people look at "a stock's" story. These are visual pictures of the price movements over time. They can show you the ups and downs, the periods when the price was fairly steady, or when it moved quite a lot. For "A stock," looking at a chart can help you quickly grasp the general direction the shares have been taking, or perhaps if they've been moving in a choppy way. It's a really quick way to take in a lot of information without having to look at a long list of numbers, which is kind of nice.

These visual aids, along with the raw numbers, give people a fuller picture of "a stock's" journey. You can see how the price has changed, where it might have faced challenges, or where it seemed to gain strength. So, when you're looking at Agilent's shares, or "A stock," getting a feel for its past behavior through its history and charts is a pretty common step for many people who are trying to make sense of things, you know, before they make a decision about it.

What news matters for "a stock"?

When you're looking at "a stock" like Agilent's, the news around the company can really play a big part in how its shares perform. News can come in many forms, from announcements about how much money the company made, to new products they might be bringing out, or even changes in who is running the business. All these things can make people feel more, or less, positive about the company's future, and that feeling can show up in the share price, you know.

Headlines about "A stock" are often something people keep an eye on. A headline might talk about a big new contract the company won, or maybe some government rules that could affect their business. These kinds of stories can sometimes cause the share price to move quite a bit, either up or down, as people react to the fresh information. So, staying current with the news is, in some respects, a way to understand why "a stock" might be behaving the way it is on any given day.

Sometimes, the news isn't just about the company itself, but about the whole industry it's in. For "a stock" like Agilent, which is involved in scientific instruments and life sciences, news about breakthroughs in those fields, or changes in how healthcare is funded, could also have an effect. It's like, the bigger picture can sometimes influence the smaller picture, meaning the company's shares. This is why people often look beyond just the company-specific news to get a more complete view, which is pretty important.

Ultimately, the news acts like a constant stream of updates that can help people decide if "a stock" is still a good fit for their plans. If there's a string of good news, people might feel more inclined to buy. If the news is not so good, they might think about selling. It's really about how the information changes people's ideas about the company's path forward, and that can have a direct impact on the value of "A stock," as a matter of fact.

How do people look at "a stock" to make choices?

When it comes to deciding what to do with "a stock," whether to buy more of it or perhaps sell what you have, people usually go through a process of looking at different pieces of information. It's not just a random guess; there's often a bit of thought that goes into it. This involves gathering various facts and figures about the company and its shares to help form an idea of what might happen next. So, for "A stock," this means pulling together all the different bits of data that are available, which is pretty much how anyone approaches these kinds of choices.

One thing people often look for is what's called a "price target" for "a stock." This is basically an educated guess about where the share price might go in the future, usually over the next year or so. These targets are put out by people who spend their time studying companies and their markets. While they are just guesses, they can give you a general idea of what some experts think the shares could be worth. For "A stock," seeing what different price targets are can help you compare your own thoughts with what others are predicting, which is useful, you know.

Another piece of the puzzle is dividend information. Some companies, including some like Agilent, give a portion of their profits back to the people who own their shares. This payment is called a dividend. Knowing if "a stock" pays a dividend, and how much it pays, can be a big deal for some people, especially those who are looking for a regular income from their holdings. So, for "A stock," checking its dividend history and current payouts is something many people consider when making their decisions, actually, as it can add to the overall appeal of the shares.

All these elements—the general analysis, the price targets, and any dividend information—come together to help people form their own opinion on "a stock." It's about building a picture that feels complete enough to act on. The goal, typically, is to make a choice that aligns with your own financial goals, whether that's growing your money, getting a steady income, or something else entirely. So, looking at "A stock" through these different lenses is a common approach for people making their investment choices, really.

Getting a feel for "a stock" through its money picture

To really get a sense of "a stock" like Agilent Technologies, Inc., you often need to look at the company's money picture, which people sometimes call its "financials." This means checking out how much money the company brings in, what it spends, and what it has in terms of assets and what it owes. It's like looking at a household budget, but on a much, much bigger scale. For "A stock," these money details give you an idea of how healthy the company is from a cash point of view, which is pretty important.

Within these money pictures, you'll find what are sometimes called "key statistics." These are numbers that help you compare the company to others in its field, or to its own past performance. They might show things like how much profit the company makes for every dollar of sales, or how much debt it has compared to its size. These statistics for "A stock" can give you a quick way to gauge its performance against some common benchmarks, which is kind of like getting a quick health check on the business, you know.

Then there are the "fundamentals." This term refers to the basic things that make a company strong or weak, financially speaking. It's about looking at the core business itself, its products, its management, and its market position. For "A stock," looking at its fundamentals means going beyond just the daily price changes and trying to understand the underlying strength of the company. It's about asking if the business itself is built on a solid foundation, which is a really big piece of the puzzle for many people.

All these money details, the statistics, and the fundamentals, they all work together to give you a more complete idea of "a stock's" overall health. It's not just about what the shares are trading for today, but about the company's ability to keep making money and growing in the future. So, when you're looking at Agilent's shares, taking the time to understand its money picture is a pretty common and, honestly, quite necessary step for anyone who wants to make a thoughtful choice about where to put their money, as a matter of fact.

Is "a stock" worth its current value?

A question that often comes up when people look at "a stock" is whether it's truly worth what it's currently selling for. This idea is called "valuation." It's about trying to figure out if the shares are priced fairly, or if they might be a bit too expensive, or even a good deal. For "A stock

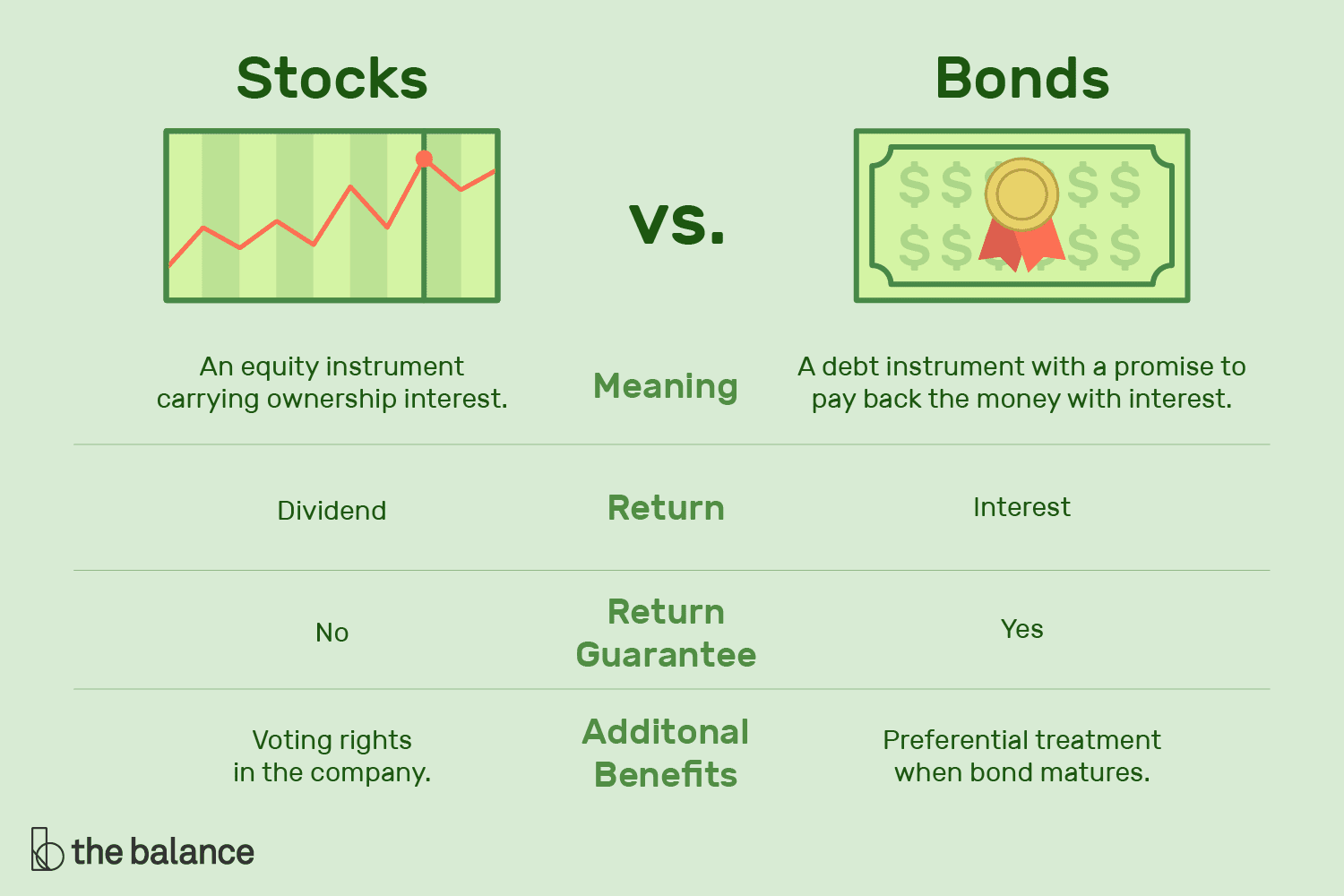

Whitehead Wealth Management - Blog #4: The Basics - Stocks and Bonds

/GettyImages-801479766-4fa7b4a1dd1d49b799565a733c9fb29d.jpg)

How Company Stocks Move During an Acquisition

21 Things to Know Before You Buy Stocks | The Motley Fool